Eagle’s Wings Foundation’s appreciates donations from all of our generous and supportive members. For our US members, Eagle’s Wings Foundation has made it easier than ever to give back in a meaningful way. We are proud to announce that our new brokerage account has been opened to allow direct stock donations from our members. Giving stock, mutual fund shares and other non-cash assets to charity is an effective way to make a significant philanthropic impact – AND at the same time, receive comparatively higher tax benefits than for cash donations. How can this benefit you?

Receive a Tax Deduction

Because Eagle’s Wings Foundation is a registered a 501(c)(3) public charity, it is a qualified charity, and most donors can claim an income tax deduction for the stock’s full market value at up to 30% of annual adjusted gross income (AGI). And in some areas, state and local income tax deductions may also be applicable. Current IRS guidelines outline how donors can deduct the fair market value of non-cash donations such as stock and mutual fund shares. It also provides information on how to write off non-cash donations if itemized deductions exceed the standard amount for single or joint filers:

- If total non-cash donations are under $500 for the year: report on Schedule A, Form 1040 line 12.

- If total non-cash donations are $500 – $5,000 for the year: Report on Form 8283, which can be attached to Form 1040.

- If total non-cash donations exceed $5,000 for the year: Report on Section A and/or Section B on Form 8283, depending on the type of securities donated.

Avoid Capital Gains Tax

In addition to a tax deduction, gifting stock avoids federal capital gains tax If the value of your stock shares has appreciated since you bought them (at least one year), any profit you would earn from selling the shares is subject to capital gains tax. This can be up to 20% depending on your income and filing status. If you donate those shares to Eagle’s Wings instead, you can avoid paying the capital gains tax. This is an advantage if you’re looking to offset a portion of your overall capital gains tax liability.

Do More Good – Maximize the Amount of your Donation

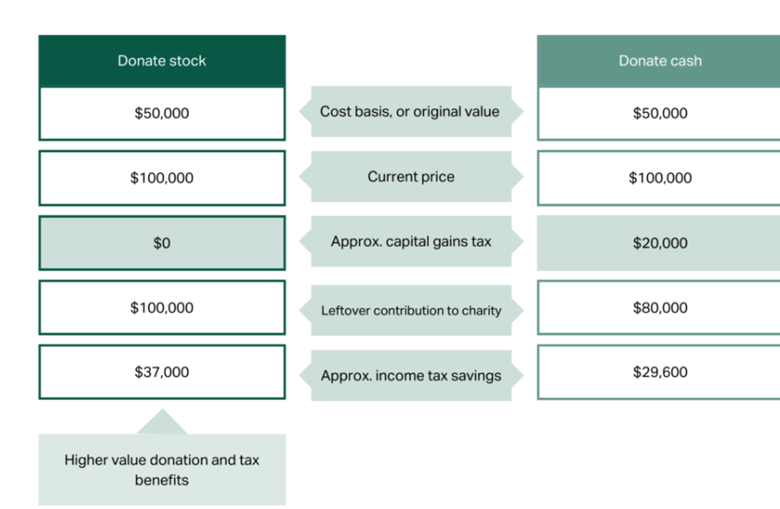

When you give appreciated stocks directly to Eagle’s Wings, your donated amount can be up to 20% higher because you save the taxes you would have to pay if you sold them and just donated the cash. This means more money going directly to Eagle’s Wings and all the wonderful work it is doing for thousands of children, men and women in the Puerto Vallarta, Los Cabos, Cancun, and Loreto communities. See the hypothetical example below to visualize the difference in tax benefits and total donation amounts when comparing a stock donation versus a cash donation.

Donate Directly from your IRA

For members 70 ½ or older, you can give any amount up to $100,000 directly from your IRA to Eagles Wings Foundation and will not pay income taxes on the transfer. And you can use your gift to Eagle’s Wings to satisfy all or part of any minimum distribution obligation.

Donating is Convenient, Fast & Easy!

Depending on how you are donating, your broker may need you to supply you with your share quantity, fund symbol, or other information.

For the JP Morgan Chase contact information for check deposits, incoming wire transfers, or securities, please contact Ana Galvan, EWF Board Treasurer at anag@resortcom.com, or Cynthia Lasher, EWF Board Secretary at cynthial@rsortcom.com.

Please note that any tax-related gift or donation must be received by December 31 in order to be reflected on your 2024 tax return.

YOU CAN MAKE A DIFFERENCE

Making a positive difference to the lives of others, however small or large, can bring meaning to your life. Dependent on your generous support, Eagle’s Wings Foundation’s programs work to provide families with food, clothing and shoes for children, care and companionship for senior citizens, medical supplies and treatments for the sick and terminally ill, education scholarships, and many more types of assistance.

This content is for informational purposes only. Please contact your tax and/or legal professional for any legal, tax, investment, or financial advice.